Created by Congress through the Medicare Modernization Act in 2003, health savings accounts (HSAs) aim to assist those with high-deductible […]

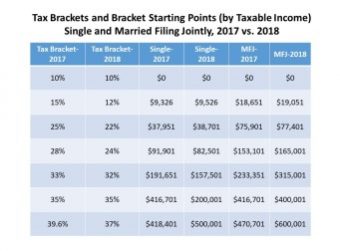

The Tax Cuts and Jobs Act (TCJA), signed into law in late 2017, significantly changed tax brackets, deductions, and other […]

Last week, President Trump signed into law a tax overhaul bill that will significantly affect tax liabilities for corporations and […]

As April quickly approaches, many Americans have reluctantly turned their attention to filing their annual income taxes. Hopefully, this task […]

While regular contributions to Roth IRAs are allowed only for those under a particular income limit, there are a couple […]

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870