Last week, President Trump signed into law a tax overhaul bill that will significantly affect tax liabilities for corporations and individuals starting in 2018. The corporate tax rate is set to drop next year from 35 percent to 21 percent. How this trickles down to impact jobs, wages, and the greater economy will unfold over the coming years. The impact on individuals’ tax bill, however, can be ascertained with more certainty, so it makes sense to consider how it will affect you and whether you should take action in the coming week or months to react accordingly.

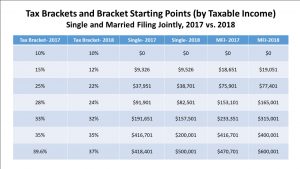

Major Changes. The two biggest changes in the tax overhaul law are: 1) a decrease in the tax brackets, and 2) a change in taxpayers’ ability to claim personal exemptions and itemized deductions. The decrease in tax brackets means that, for most Americans, more of their income will face a lower percentage tax rate. See the chart below for details. This will be a  positive change for the vast majority of individual taxpayers. In contrast, the changes in rules for deductions will have mixed results, depending on the number and age of your dependents, whether you itemize deductions, and if so, how much your itemized deductions are. Under the new tax law, you will no longer be able to claim personal exemptions, which currently allows you to deduct around $4k from taxable income for you and each of your dependents. If, however, your dependents qualify for the child tax credit, you may still win under the new law, since the child tax credit will double to $2k per eligible child and the thresholds for phasing out the credit will be pushed significantly higher (so even higher-income parents may be able to claim it). There will also be a new ($500) credit for non-child dependents.

positive change for the vast majority of individual taxpayers. In contrast, the changes in rules for deductions will have mixed results, depending on the number and age of your dependents, whether you itemize deductions, and if so, how much your itemized deductions are. Under the new tax law, you will no longer be able to claim personal exemptions, which currently allows you to deduct around $4k from taxable income for you and each of your dependents. If, however, your dependents qualify for the child tax credit, you may still win under the new law, since the child tax credit will double to $2k per eligible child and the thresholds for phasing out the credit will be pushed significantly higher (so even higher-income parents may be able to claim it). There will also be a new ($500) credit for non-child dependents.

Regarding deductions, under the new law, the standard deduction will nearly double—from $6,350 to $12,000 for single filers and from $12,700 to 24,000 for married persons filing jointly. In addition, there will be new limits on certain itemized deductions. The total amount that taxpayers can deduct for state and local income taxes or sales tax and real estate taxes will be capped at $10k (regardless of filing status). This deduction has been unlimited in years past, so this change will negatively affect many itemizers, especially in localities with high state or local income tax rates (like the District of Columbia) or in areas with high real estate taxes (like Northern Virginia). Many miscellaneous deductions (e.g. for tax preparation, investment expenses, job-related expenses) will disappear, and homeowners’ ability to deduct interest for home equity loans or lines of credit will be limited as well. The mortgage deduction will be capped for interest on mortgages up to $750k for new mortgages starting in 2018. Currently, just over one quarter of taxpayers itemize deductions, but in light of these changes, it will no longer be advantageous for many of those to do so starting in 2018.

What to Do in the Coming Week. If you have control over the timing of your income—e.g. you could push back the timing of a bonus check, self-employment income, or commissions by a couple weeks—you may want to move that income into 2018 to take advantage of the lower tax brackets. If you generally itemize deductions and either will likely switch to the standard deduction next year or will likely be hurt by the changes to itemizing state, local, and real estate taxes and/or miscellaneous expenses, you may want to try to capitalize on the current itemized deduction rules for 2017. While the new law prohibits prepaying state or local income taxes for 2018, you can prepay real estate taxes in many jurisdictions, including Fairfax County, VA, and—as of yesterday—Montgomery County, MD. You also may be able to prepay certain job-related or tax preparation expenses. In addition, while the new law does not change one’s ability to deduct charitable contributions, if you are likely to take the standard deduction instead of itemizing in 2018, you may want to make those donations this week, so that you can claim them on your 2017 taxes.

What to Do in the Coming Months. It is very important in the coming months to consult with your tax professional and financial advisor to see how the details of the new tax law will impact you going forward. Beyond the major changes discussed above, there are numerous specific provisions that could influence your optimal tax strategy—as well as how much you should be withholding from your paycheck to cover your projected tax liability going forward. For example, in 2019, the tax treatment of alimony payments will change for any new divorce agreements created after 2018—with ex-spouses paying alimony no longer able to deduct it from income and ex-spouses receiving alimony no longer needing to claim it as income. Parents sending their kids to private school may want to rethink their strategy for saving and paying tuition since, under the new law, funds in 529 accounts can now be used for private school tuition for grades K through 12. Also, there are changes to deductions and phase out thresholds for the Alternative Minimum Tax (AMT), an increase in the estate tax exemption, and a rescission of investors’ ability to reverse Roth conversions starting in 2018. A number of financial publications are offering online calculators to give taxpayers a sense of how the new law may impact them—such as Wall Street Journal (the most thorough), Market Watch, and CNN.

As mentioned above, given the changes to the tax brackets, this law appears to be a net positive for most taxpayers in the coming years. Many of the new provisions, however, are set to expire in 2025, so the long-term impact on individual taxpayers is yet to be determined. Consulting with tax and financial planning professionals will provide more specific insights into your situation and will help determine how you can optimize your tax strategy in light of the new law. The impact of the new law might be best reviewed in detail after you have completed your 2017 tax return, so that you have the most current information possible when doing the analysis.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870