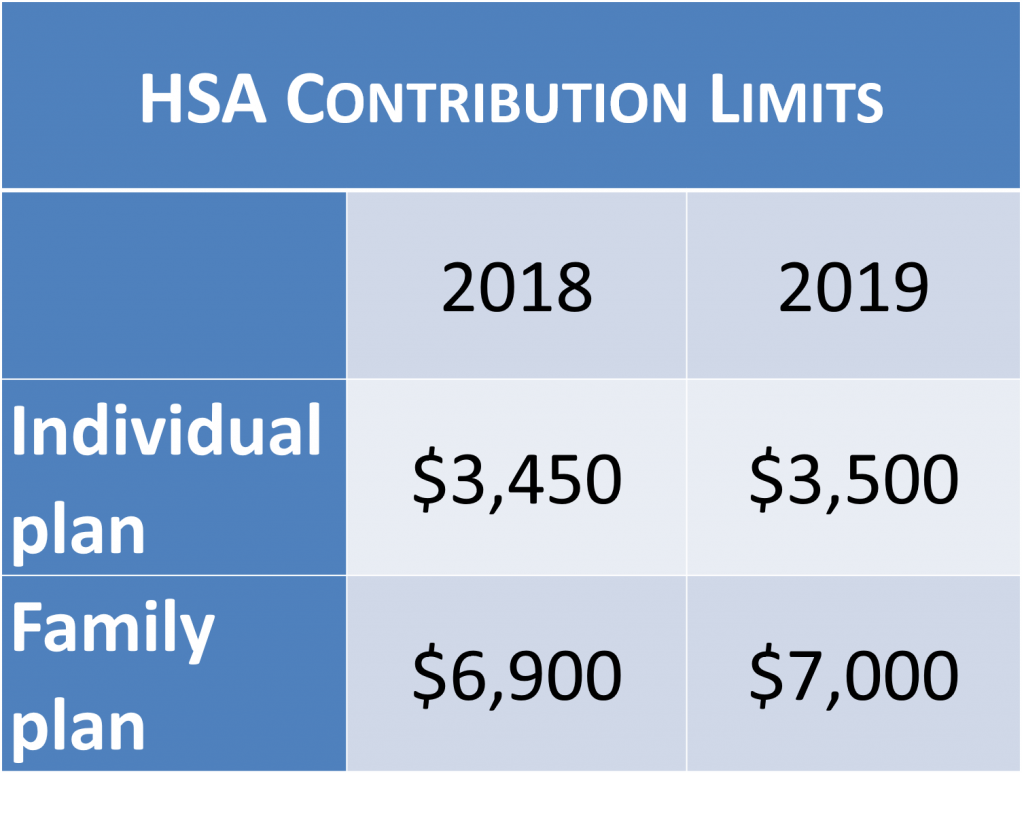

Created by Congress through the Medicare Modernization Act in 2003, health savings accounts (HSAs) aim to assist those with high-deductible health insurance plans (HDHPs) in saving for out-of-pocket medical expenses. For your health insurance plan to be considered an HDHP, it must have a deductible of at least $1,350 for an individual or $2,700 for a family in 2018  (same in 2019). If you have an HDHP, the maximum amounts that you can contribute to an HSA are listed in the chart to the right. Those over age 55 can also contribute an additional $1,000 per year.

(same in 2019). If you have an HDHP, the maximum amounts that you can contribute to an HSA are listed in the chart to the right. Those over age 55 can also contribute an additional $1,000 per year.

Why would you want to save to an HSA, and should you save more than the amount you need for near-term medical expenses? Consider the six facts about HSAs below.

#1: HSAs offer a triple income tax advantage. HSA funds are saved pre-tax, can grow tax-deferred, and can be withdrawn tax-free. HSA savings are excluded from your taxable income if deducted from your paycheck or can be deducted from income on your tax return if contributed to an HSA not affiliated with your employer. Once in the HSA, funds can be invested without any tax on interest, dividends, or capital gains, and then can be withdrawn without tax if used for qualified medical expenses. In this way, HSAs have greater tax benefits than other tax-favored accounts, including 401(k)’s and IRAs (which are saved pre-tax and grow tax-deferred but are taxed on withdrawal) and Roth IRAs (which grow tax-deferred and are withdrawn tax-free but are saved post-tax).

#2: HSA savings from your paycheck avoid FICA (payroll) taxes. You don’t have to pay Social Security or Medicare taxes on funds directed to an HSA from your paycheck, which amounts to an additional 7.65% savings (1.45% savings if you are already over the Social Security wage base). This also provides significant incentive to use the HSA company affiliated with your employer, rather than setting up an outside HSA account.

#3: HSA funds not needed for medical expenses can be withdrawn without penalty after age 65. Prior to age 65, funds taken from HSAs that are not used for qualified medical expenses are subject to a 20% penalty, in addition to income tax. After age 65, they are only subject to income tax (similar to withdrawals from traditional IRAs or other retirement accounts).

#4: You can withdraw funds from the HSA for Medicare premiums. After age 65, you can also use HSA funds to pay for Medicare Part B (medical insurance), Part C (Medicare Advantage Plan), and/or Part D (prescription drug coverage). Once you are enrolled in Medicare, however, you must stop contributing to your HSA, and you cannot use HSA funds to pay the premiums for Medicare supplemental insurance (i.e. Medigap policies).

#5: HSA account owners can pass along HSA assets to their heirs. If you pass away as the HSA account owner, your spouse can inherit and use the HSA without any tax consequences. If non-spouse beneficiaries inherit the assets, the full inherited amount is taxable in the year of your passing.

#6: Most (but not all) HSAs offer the option to invest funds for long-term growth. You often have to maintain a minimum balance (e.g. $1,000) apart from invested HSA funds. You also will likely face additional fees (either a flat rate or percentage of assets) for investing HSA funds, in addition to the usual monthly maintenance fee on the account. The cost and availability of quality investment options varies by HSA provider. According to Morningstar, only a small minority of HSA account owners take advantage of the option to invest HSA funds.

Given the tax benefits, anyone with an HDHP should strongly consider using the HSA to save for near-term medical expenses rather than paying for them directly out-of-pocket. Whether or not you should save additional amounts to the HSA to invest for long-term growth depends in large part on your level of positive cash flow and your financial goals. For example, saving directly for retirement should be a priority for most workers, especially if you can receive an employer match through your 401(k) or 403(b). If you have kids and aim to pay for some or all of their college expenses, then that should be a priority each month after contributing to your retirement account. If, however, you are already contributing the maximum to your retirement account, do not have other competing savings priorities, and are interested in minimizing taxes as much as possible, contributing the maximum to your HSA is a very attractive opportunity.

If you have questions about the extent to which you should be saving to an HSA, please do not hesitate to give us a call.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870