U.S. ships are required to conduct lifeboat drills, making sure that passengers and crew are adequately prepared on how to respond in case of an emergency at sea. Many financial advisors advocate that their clients do the same. Take a minute to consider what you will do the next time the stock market drops 20 or 30 percent. Will you panic and be tempted to pull assets out of your stock funds (even though you know that it would be the worst time to do so)? Or will you try to ignore the headlines, remember that you are investing for the long term, and stay the course?

The U.S. stock market has jumped over 100 percent in the last 5 years. As a result, many investors’ portfolios are worth more than they ever have before, which means that the next time the stock market drops by 20 percent, the amount of dollars “lost” from those investors’ portfolios will be more than in any previous market correction. For example, imagine that your portfolio has grown from $2 million to $4 million over the past 5 years. That means that while a 20 percent decline in your portfolio in 2020 resulted in a loss of $400k, a 20 percent decline now would result in a loss of $800k. That’s a big number. Are you ready to stick with your investment strategy and tune out the noise?

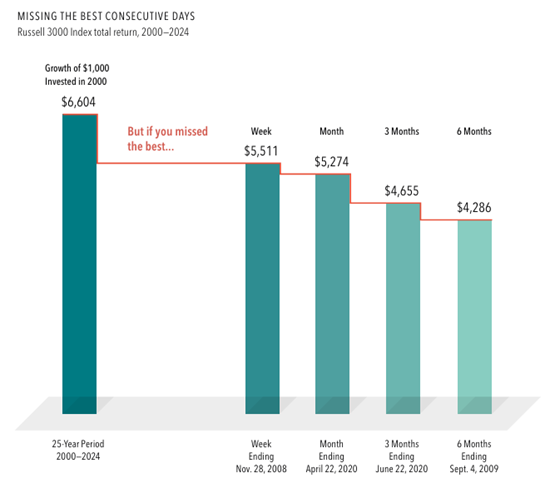

Hopefully, your answer is yes because the consequences of switching strategies at the wrong time can be severe. Dimensional Fund Advisors outlines these consequences in the graphic to the right. An investment of $1,000 in U.S. stocks (represented by the Russell 3000 Index) in the year 2000 would have grown to $6,604 by the end of 2024 if left continuously invested. However, those who pulled money out at inopportune times and missed the best week, month, 3 months, or 6 months during that timeframe would have lost at least $1,000 (upwards of $2,300) of that growth. And note that those periods of high growth occurred on the heels of the biggest market downturns during that time period—in late 2008 / early 2009 (Great Recession) and in the spring of 2020 (Covid) – when many investors were tempted to cut their losses and sell out of their stock funds.

For PFS clients, remember that we have a long-term investment strategy to help you meet your financial goals, crafted with your particular financial situation in mind, and that we have invested your nest egg in a diversified portfolio to help you weather whatever storms lie ahead. When the next storm comes, grab a life vest, and we will navigate the rough seas together!

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870