While the individuals and families that we serve as clients are a diverse group, one goal that all of our working clients have in common is that at some point they would like to retire. We want to help them achieve this goal, and the financial plans that we prepare examine how to achieve this in detail. However, absent a detailed financial plan, there are a few general guidelines to consider in determining how much to save from your monthly salary toward retirement.

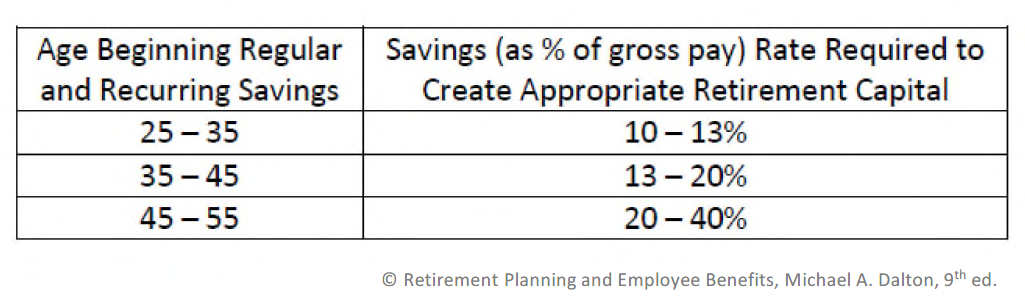

Starting Age. The age at which you begin saving is one of the most significant factors impacting how much of your salary is required to achieve this goal. Savings early in your career have longer to compound and are therefore particularly beneficial. Each year, you earn investment returns not only on your initial retirement contributions but also on the returns of previous years. The chart below outlines approximate percentages, depending on your starting age, of necessary retirement contributions, which includes both your employee contribution and any employer match.* For example, if you contribute 7% of your salary to your 401(k), and your employer matches dollar-for-dollar up to 5% of employee contributions, then you are saving 12% of your salary toward retirement for the purposes of this chart.

Risk Tolerance. If you are wary of market risk and invest your retirement savings in a higher percentage of cash and bonds than a typical balanced portfolio (generally characterized as 60% equity / 40% bonds), then you will need to save a higher percentage of your salary toward retirement. Investing more conservatively will lessen the volatility of your portfolio but will also likely produce lower investment returns and compounding over the long term.

Income Level. If you are a high-income earner or are on a career path to become one, you should save a higher percentage of your salary for two reasons. First, you are more likely to hit the IRS maximum for retirement contributions ($19,500 under most retirement plans for 2021), so you will also need to save a portion of your taxable income toward retirement, which will not have the benefit of tax-deferred growth. Second, since Social Security benefits are paid on a progressive scale, benefits for high-income earners will constitute a lower percentage of income replacement than for low-income earners. These are a couple of the reasons we often say: “The more you make, the harder it is to retire.”

Projected Retirement Age. If you intend or aspire to retire earlier than your Social Security full retirement age (age 67 for most current workers), you should also save a higher percentage toward retirement. We would not recommend the opposite, however, of saving less and planning to retire late. Based on the experiences of our clients, many individuals experience unexpected negative changes in their job situation late in their careers and find that their retirement age is not always within their control.

Other Retirement Income. If you are an employee with vested pension benefits, you may be able to save a lower percentage toward retirement. However, you should be careful in estimating your projected pension amount, since your work situation could change in the future and/or benefits could change, especially as companies move away from pension plans toward defined contribution plans (such as 401(k) plans). Similarly, Social Security benefits may change in the future since payroll taxes will be insufficient to cover the full amount of scheduled benefits within the next two decades.

The most significant point to act upon, or to repeatedly pester your children, grandchildren, nieces and nephews, or younger friends about: the earlier you start saving for retirement— and the more you are able to save at a young age— the better. Let the benefits of compounding do some of the work for you!

*The percentages in the chart above assume that savings are invested in a balanced portfolio with a “reasonable” risk profile relative to age, that retirement occurs at the Social Security full retirement age (unless savings do not start until 55, at which point retirement will likely need to be delayed until age 70), and that income needs in retirement will be about 80 percent of pre-retirement salary, including Social Security benefits.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870