This has been a very volatile year in the stock market, and with the election outcome uncertain and the pandemic unresolved, there may be more volatility still in store. However, “conservative” investments—such as bonds, CDs, and money market funds—carry certain risks as well, especially if they comprise too much of your portfolio over the long-term. Here we explain how inflation can affect the purchasing power of your investments over the long run, particularly in a low interest rate environment.

The PFS staff, like most red-blooded Americans, are big fans of ice cream, particularly Woody’s Ice Cream—a staple of Fairfax City. Given our affection for ice cream, we will use this essential consumer product to demonstrate why it is safer to invest a portion of your retirement savings in stock funds, rather than sticking only to “conservative” alternatives such as cash and bonds.

Woody’s Ice Cream is owned by Woody, who retired from the auto business in 1996 and opened his ice cream store a couple years later. Assume that when Woody retired from the auto business, he had $1,000 in savings. At  that point, Woody could afford to buy 375 half-gallons of ice cream. However, the average price of ice cream increased from approximately $2.67 per half-gallon in 1996 to $4.82 at the beginning of 2020. Therefore, if Woody had stashed his savings in cash under his mattress, he could only afford 207 half-gallons as of the beginning of this year—a significant decline in his ability to buy ice cream.

that point, Woody could afford to buy 375 half-gallons of ice cream. However, the average price of ice cream increased from approximately $2.67 per half-gallon in 1996 to $4.82 at the beginning of 2020. Therefore, if Woody had stashed his savings in cash under his mattress, he could only afford 207 half-gallons as of the beginning of this year—a significant decline in his ability to buy ice cream.

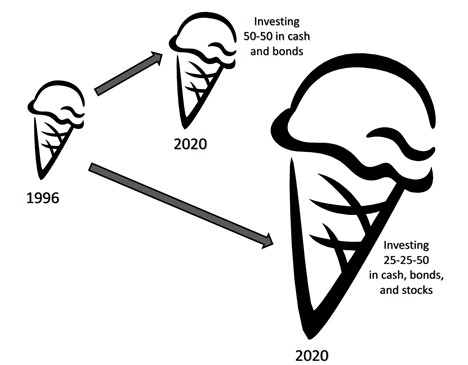

If Woody had invested half of his savings in U.S. bonds (represented by Barclays U.S. Aggregate Bond Index), he could afford 442 half-gallons of ice cream by 2020, a slight increase in purchasing power. By comparison though, if he had invested his savings in a mix of cash (25 percent), U.S. bonds (25 percent), and equities (50 percent, represented by the S&P 500), he could afford 1,079 half-gallons of ice cream as of the beginning of 2020–almost a 200% increase in his ability to buy ice cream!

The lesson is clear: while the risks of investing in the equities market may grab more headlines, choosing the “safe” bet of only (or predominantly) investing in cash or bonds may not be so safe over the long term. You may have felt anxiety in light of the stock market volatility this year, but bear in mind that inflation trudges on, and it will erode the purchasing power of your savings (i.e. reduce your ability to buy ice cream) if you don’t invest in assets that will produce inflation-beating returns over the long term.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870