How the Coronavirus Emergency Relief Package Impacts You, Part 1: Show Me the Money

by Professional Financial Solutions | April 1, 2020 | Current Events

Last Friday, President Trump signed

the Coronavirus Aid, Relief, and Economic Security (CARES) Act—the biggest

emergency relief package in history, with an estimated price tag of $2 trillion.

How such massive spending will affect our nation’s financial stability

over the long-term—or even its economic growth over the relatively

short-term—is difficult to predict.

However, many of the provisions in the law will directly impact individual

taxpayers (including most PFS clients) this year, so, to save you the trouble

of wading through the characteristically verbose 880-page law, we will

highlight those items for you. This post

will discuss the topic that is likely to be foremost on your mind—the cash

distributions that the government will send within the next month or two. Later this week, we will publish two additional

posts analyzing how the CARES Act alters retirement account rules for 2020 and how

it provides cash flow relief that may be relevant to our clients.

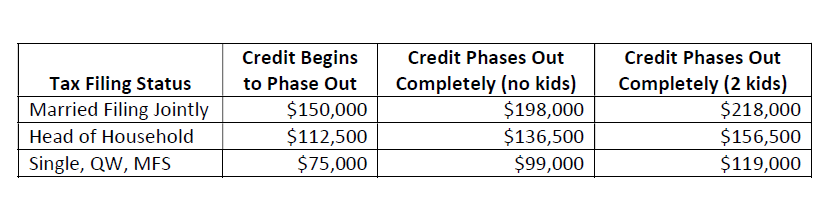

Cash Distributions. As you have likely heard, in April, the federal government plans to send $1,200 to each adult ($2,400 to married couples) and $500 for each dependent child under age 17, subject to certain income requirements (see below). Once your income hits the phase-out range, you lose $5 of payment for every $100 that your income exceeds the beginning of the phase-out range. Thus, the phase-out range is wider for individuals with children because they are eligible for a larger payment.

The IRS will determine your level of income based on your 2019 tax

return if you’ve filed it already. If

not, it will be based on your 2018 tax return—or on your 2019 Social Security benefit

statement, if your income was low enough that you didn’t have to file a tax

return in 2018 or 2019. Checks will be

direct deposited to the bank account listed on your 2019 (or 2018) tax return,

or, if an account is not available or no longer valid, a check will be mailed

to the address on your return.

- Planning Opportunity: If you have not already filed your 2019 tax return, your 2019 income falls in the phase-out range outlined above, and your income is higher in 2019 than 2018, we recommend that you wait to file your 2019 return until after the checks have been delivered. (If you haven’t heard, the IRS has extended the deadline for submitting your tax return to July 15th.) The checks are actually an advance on a tax credit that will be included on your 2020 tax return. This will allow for certain individuals, whose income was actually lower (or number of dependent children higher) than estimated, to benefit from an additional tax credit when they file their 2020 returns. However, there is no provision in the law for repaying a portion of the checks if the government underestimates your income. When the government distributed stimulus checks in 2008, it did not require repayment for errors in the taxpayers’ favor, and this seems to have been confirmed by the House Ways and Means Committee for the 2020 checks as well. Therefore, there appears to be no downside risk for waiting to submit your 2019 tax return if it will negatively impact the amount of your CARES Act cash distribution. Apart from changes in income, if you’ve had any other life changes from 2018 to 2019 that could impact the amount of your check—e.g. marriage, divorce, new baby—consider whether that would have a positive or negative effect on your cash distribution before filing your 2019 taxes as well.

- Personal vs Societal Well-Being. The purpose of these checks is to provide immediate aid to low- and middle-income Americans who might be struggling to make ends meet during this crisis. If you fall into this category—or fear that you might fall into this category due to job loss or salary cuts in the near future—it would certainly be wise to use the check for immediate expenses or save it in a liquid emergency fund for near-term expenses. If, however, you have sufficient savings and investments to comfortably ride out this storm (regardless of duration), consider using your check for the greater good. First, you could donate some or all of the amount to a charity that provides for those most in need at this time. Another positive option, if your state or municipality still allows it, would be to spend the money at small businesses in your area that are likely struggling. Finally, if you are intent on saving the money, consider investing it, rather than parking it in a savings account. By investing it, you funnel those assets back into the economy through the companies whose stock you are buying. We are concerned first and foremost with our clients’ financial stability in the coming months and years, but our country and its economy (and therefore our collective long-term financial interests) will be well-served if those who have sufficient resources consider not only how to use them wisely, but also how to use them generously at this time.

Please stay tuned for our blog posts on additional CARES Act

provisions later this week, and please call or email us with any financial

concerns during this difficult time.