At PFS, when we create financial plans for our clients, we make assumptions for the average annual investment returns that clients might reasonably expect from their portfolio over the long run, based on long-term historical returns for various asset classes. We try to emphasize, however, that the return on a client’s portfolio will rarely, if ever, exactly match that percentage in any given year. As we experienced in the fall of 2018, investing in the stock market will be a very bumpy ride— but, as investors, we get rewarded for taking market risk. We can reasonably hope for significant growth over the long term only because there is a risk of an equally (or more) significant drop in any given year as well.

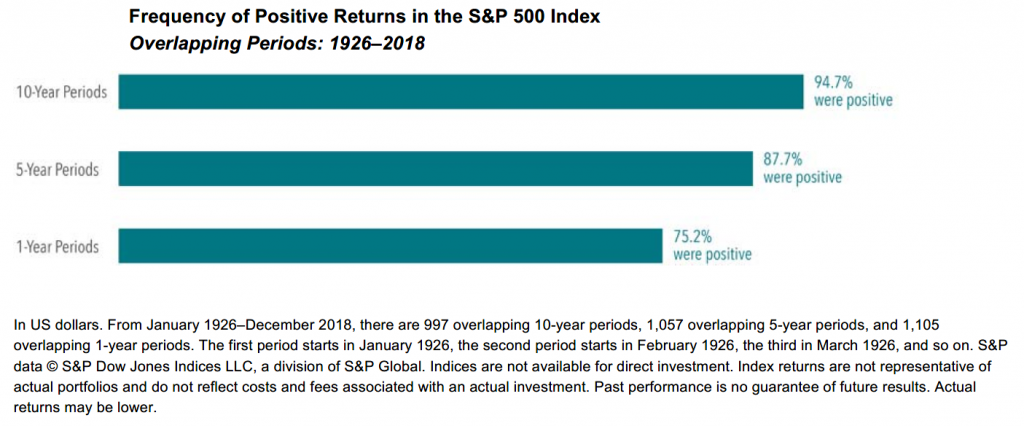

Dimensional Fund Advisors (DFA) published an article last week (copied below) that demonstrates just how rarely the stock market behaves exactly as expected. Looking at the annual returns of U.S. large company stocks over the past 93 years, the returns for any given year only fell within 2 percentage points of the long-term average on 6 occasions, and they produced negative returns for the year on 25 occasions. Even over longer time horizons (e.g. 5-year and 10-year timeframes), there is a chance of negative returns.

Fortunately, there are ways to mitigate this inevitable volatility. Having an appropriate allocation of cash and bonds (and investing in relatively high-quality bonds as opposed to more volatile junk bonds) can help insulate investors from the gyrations of the market. Just like the proverbial tree falling in the woods—if your stock portfolio drops 20 percent and you don’t sell any of it, does it really lose value? We know that any client entering into retirement with 20 to 30 years of life expectancy ahead of them will experience many such dips in the market. But, if we can manage their portfolio effectively, and they don’t have to sell stocks during a market decline, then a temporary dip in stock value is really like the sound of the tree falling that no one hears. It will not materially impact your financial (or, hopefully, your emotional) well-being.

What matters most in investing is not whether we will experience market corrections (spoiler alert: we will!) but how investors plan for and react to volatility in the market when it occurs. If you have any concerns about market volatility or your portfolio asset allocation, please do not hesitate to call us. On the rollercoaster ride of market investing, we are here to help you manage the highs and weather the lows, so that you can continue to meet your financial goals.

____________________________________

Dimensional Fund Advisors, May 2019

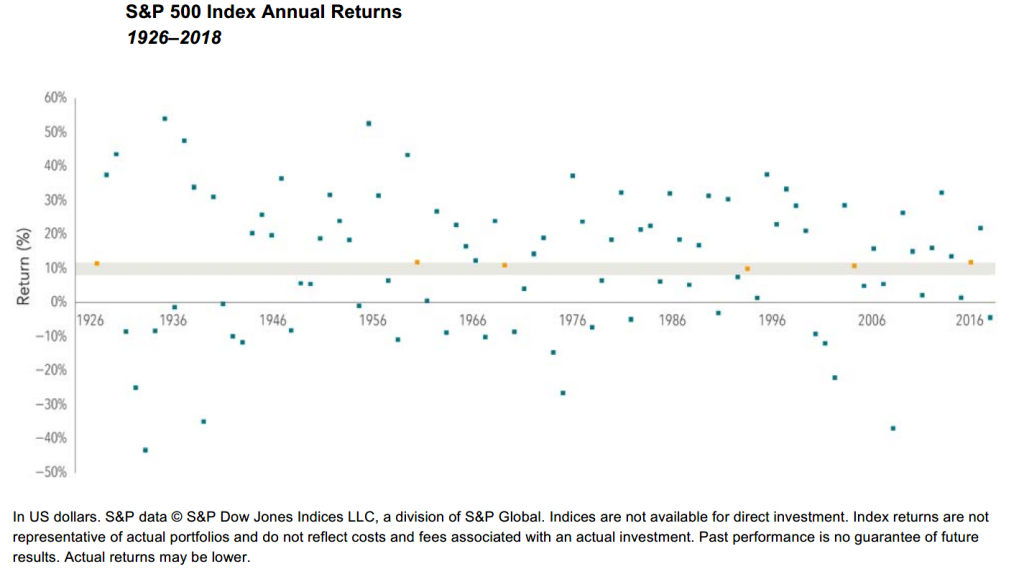

The US stock market has delivered an average annual return of around 10% since 1926. But short-term results may vary, and in any given period stock returns can be positive, negative, or flat. When setting expectations, it’s helpful to see the range of outcomes experienced by investors historically. For example, how often have the stock market’s annual returns actually aligned with its long-term average?

Exhibit 1 shows calendar year returns for the S&P 500 Index since 1926. The shaded band marks the historical average of 10%, plus or minus 2 percentage points. The S&P 500 Index had a return within this range in only six of the past 93 calendar years. In most years, the index’s return was outside of the range—often above or below by a wide margin—with no obvious pattern. For investors, the data highlight the importance of looking beyond average returns and being aware of the range of potential outcomes.

Tuning In to Different Frequencies

Despite the year-to-year volatility, investors can potentially increase their chances of having a positive outcome by maintaining a long-term focus. Exhibit 2 documents the historical frequency of positive returns over rolling periods of one, five, and 10 years in the US market. The data show that, while positive performance is never assured, investors’ odds improve over longer time horizons.

Conclusion

While some investors might find it easy to stay the course in years with above average returns, periods of disappointing results may test an investor’s faith in equity markets. Being aware of the range of potential outcomes can help investors remain disciplined, which in the long term can increase the odds of a successful investment experience. What can help investors endure the ups and downs? While there is no silver bullet, understanding how markets work and trusting market prices are good starting points. An asset allocation that aligns with personal risk tolerances and investment goals is also valuable. By thoughtfully considering these and other issues, investors may be better prepared to stay focused on their long-term goals during different market environments.

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870