Managing Inertia: The Pros and Cons of Target-Date Retirement Funds

by Professional Financial Solutions | June 25, 2018 | Maximizing Investments, Saving for Retirement

Over 300 years ago, Isaac Newton defined the concept of “inertia,” observing that objects tend to resist any change in their position or state of motion. In over 20 years of service at PFS, we can affirm that this concept of inertia regularly holds true for investors as well. Especially in retirement accounts, investors often pick an investment allocation when they first open the account, and then years pass by without them making any changes or even giving it a second thought. For some, this may result from a lack of financial savvy, but for others, it’s simply a factor of work, family responsibilities, and/or other interests taking priority.

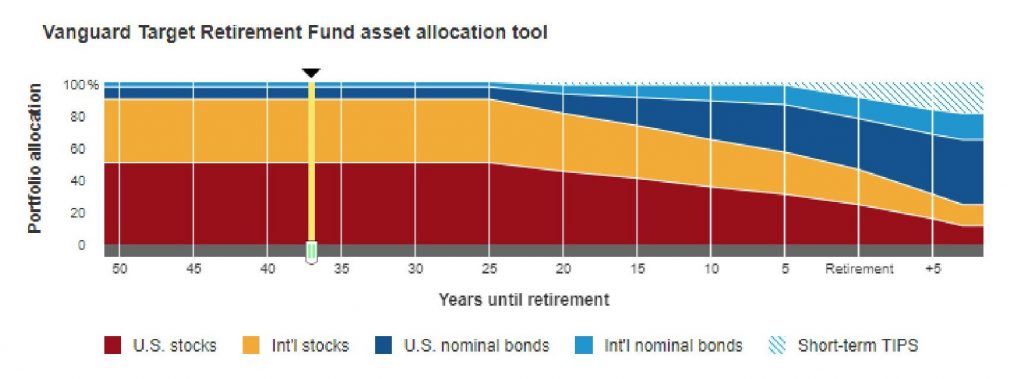

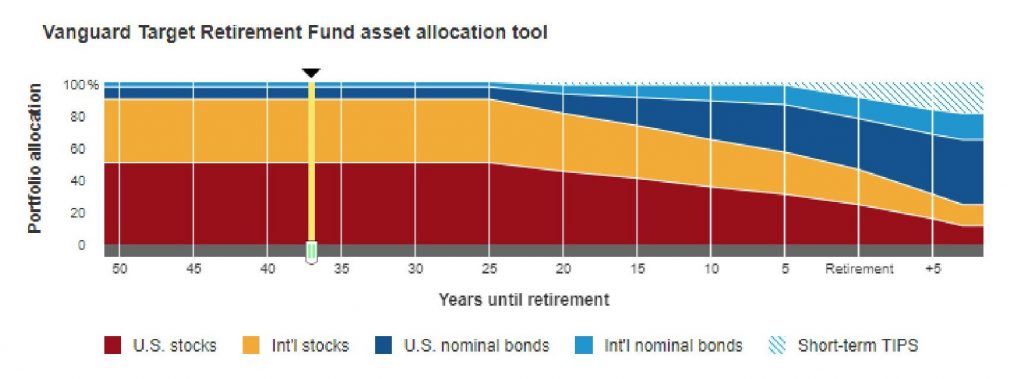

Mutual fund companies have also long observed this tendency toward inertia and developed target-date retirement funds as a possible solution. In these funds, the stock and bond holdings evolve over time, so the portfolio maintains an appropriate level of risk and volatility relative to investors’ age and situation in life. When investors are young and have many years of work ahead, the portfolio will have greater exposure to stocks, including more volatile asset classes such as small company and international stocks. As investors approach retirement age, the portfolio will  grow more conservative, reducing its stock holdings and increasing bond holdings. See, for example, how Vanguard target-date funds evolve over time in the chart to the right.

grow more conservative, reducing its stock holdings and increasing bond holdings. See, for example, how Vanguard target-date funds evolve over time in the chart to the right.

Pros. Target-date funds (also known as life-cycle funds) are an increasingly popular option in retirement plans and are now frequently used as the default option for plan participants when they begin contributing to a new retirement account. We believe this is preferable to investors’ contributions flowing into money market funds or into all-equity funds by default and then remaining there for decades due to the aforementioned power of inertia. The advantages are outlined below:

- Evolving risk/regular rebalancing. Target-date funds are a simple and convenient way of ensuring that your retirement plan account has a relatively appropriate level of risk. The fund managers shift the asset allocation to grow more conservative as you approach retirement and regularly rebalance the fund to its target allocation in the years between allocation changes.

- Diversification. Target-date funds provide immediate diversification among asset classes, often including even more diversification than would be possible by creating your own mix within your retirement plan from the non-target-date funds available. (For example, we have seen retirement plans with target-date funds that include exposure to emerging market stocks, though for investors trying to customize the mix in their plan account, the plan does not include an option to invest in an emerging markets fund.)

- Passive/low fee options. Many, though not all, target-date retirement funds follow a passive investment strategy and have relatively low fees.

Cons. While target-date funds are a relatively easy investment option, convenience always comes at a price. The challenges and drawbacks of investing in these funds are outlined below:

- Impersonal. The glide path for target-date funds (from more aggressive to conservative investments) is not tailored to your particular financial situation—changes to the investment allocation will occur automatically, regardless of whether your risk tolerance or your need for withdrawals has changed. For example, if you (or your spouse) continues working past the target retirement date or do not need to take withdrawals due to pension, Social Security, or other income, you may be sacrificing growth in your portfolio for stability that you do not need at the time.

- Varied risk profiles. Each target-date fund follows a different glide path, and their stock-to-bond ratios (thus, the amount of volatility that each fund experiences) at their target retirement date vary significantly. Some may only have a 30% allocation to stocks at target retirement, whereas some may have up to 70% in stocks. In the example of Vanguard target-date funds above, 51% is invested in stocks at the target retirement date. Target-date funds also differ in terms of when they stop making allocation changes. Some allocations remain fixed once investors are in their mid- to late-60s, while others continue changing through age 80.

- Higher fees. Even though there are some relatively low-cost options, target-date funds will generally have higher fees than other types of mutual funds because they are a compilation of funds and their allocation is managed by professionals. Therefore, they incur the expenses of the underlying funds as well as management fees. In addition, even funds that have low costs on the retail market may have a higher expense ratio when offered within a retirement plan.

- Ignore the rest of your portfolio. Target-date funds are meant to serve as a stand-alone investment product, but most investors have other accounts in their portfolio (e.g. old 401(k) accounts, IRAs, and taxable investment accounts), or they use other investment options besides just the target-date fund in their current retirement plan. If these other investments are not coordinated with the target-date fund, the volatility of their portfolio as a whole may still be inappropriate for their age and situation.

- Taxes. We have primarily discussed the use of target-date funds in retirement accounts, but if you buy target-date funds in a taxable account, beware of the tax consequences. As the fund changes its investment allocation, it will need to sell some of its current holdings, so investors will be hit with capital gains (or losses) and have to pay capital gains taxes accordingly.

Whenever a client starts a new job, we ask that they send us the investment options for their new retirement plan, so that we can advise them on the best way to proceed, given their other investments. We will occasionally use target-date funds in their employer plans, depending on the other investment options, but we more often choose to use individual funds, so that we can tailor the allocation to their specific situation. Knowing clients’ individual goals helps us manage their investments for their long-term financial success.

grow more conservative, reducing its stock holdings and increasing bond holdings. See, for example, how Vanguard target-date funds evolve over time in the chart to the right.

grow more conservative, reducing its stock holdings and increasing bond holdings. See, for example, how Vanguard target-date funds evolve over time in the chart to the right.