In this post, we focus on how much parents should aim to save in order to pay for tuition, room and board, and related fees and expenses at the time that their children reach college age. The most significant factor in how much parents should save is their goal and expectations for college funding, e.g. whether they intend to fully fund or only partially fund college expenses, whether they expect to pay in-state, private, or community college tuition, etc. However, another significant factor is how tuition inflation will compare to the investment returns of your college savings over time.

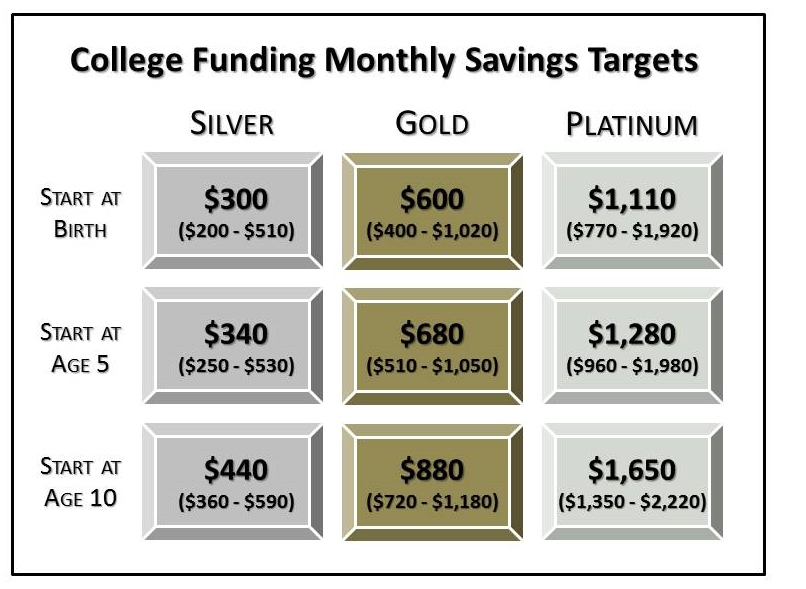

Savings Plans. The following chart outlines what we have dubbed the Silver, Gold, and Platinum savings plans. The Platinum represents saving to fully fund private college expenses (estimated at approximately $45k per year in today’s dollars), the Gold represents fully funding in-state college expenses ($24k per year in today’s dollars), and the Silver represents funding half of in-state expenses ($12k per year in today’s dollars). For each plan, we indicate the approximate monthly savings needed, depending on the age of your child when you start saving.

Assumptions. In conducting college savings analysis for our clients, we generally estimate that their college savings portfolio will earn investment returns slightly greater than the rate of tuition inflation. However, the range given at the bottom of each box in the chart indicates how the necessary savings amount can vary if investment returns beat tuition inflation by a more significant margin or if tuition inflation actually exceeds investment returns during the relevant time frame (which is certainly possible, given the high rate of tuition inflation over the past four decades).

Positive Impact of Cash Flow Savings. While the numbers in this chart may be surprising (and possibly overwhelming or disheartening … we have kids, we know the feeling), it may be some consolation to consider the impact on your cash flow of having a child go to college. Even prior to college, kids cost money. Some of the costs that parents grow accustomed to paying out of their monthly cash flow (for kids’ food, education, activities, etc.) will now be covered by college expenses. This is even more pronounced if you pay for private secondary school education. Parents can generally expect to be able to pay for 5% to 20% of annual college expenses out of their regular cash flow, depending on how expensive their children’s activities and other needs were in high school and whether the child is attending an in-state or private college. If parents are accustomed to paying for private high school tuition as well, the amount that they will likely be able to pay from monthly cash flow may rise to 50% or more of annual college expenses. Therefore, the amount of necessary monthly savings from the chart above could be deflated by 5% to 50%, depending on your child’s pre-college expenses. (We would encourage you to be conservative, however, in estimating this amount, since financial hardships, such as job loss or temporary disability, at an inopportune time could derail your plans to pay for a portion of college expenses out of cash flow.)

The most important piece of advice we can give is that if you have not yet started saving for your children’s college education, start today. Even if you start small, it will help establish the habit and give you the benefit of a longer timeframe in which your investment can grow, hopefully at a faster rate than college tuition does!

If you have any questions about your financial future, we're here to help. Please use this form or feel free to call or e-mail us.

(703) 385-0870